Mixed signal.

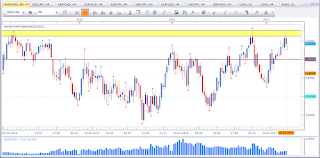

AUD vs CAD

Bearish bias for the week.

This is AUD vs CAD weekly timeframe. Price is testing resistance marked with the yellow rectangle. This puts my bias in favour of the bears. I was looking for a run deeper in the yellow zone, but we do not always get what we want. A follow through on the Dark Cloud Cover would mark a lower top, which would be another sign of weakness.

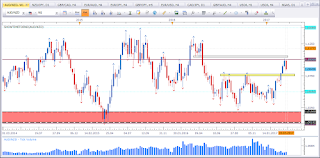

CAD vs JPY

Mixed signal.

This is CAD vs JPY weekly timeframe. Price did break out of the small congestion zone to the downside with a healthy bearish candle. This normally puts my bias in favour of the bears. However, price is at support and this break below may merely be a trap. I need further signs to establish a bias. Maybe we'll get a setup for next week. I am ready to look for setups in both ways. But am not eager to take a trade on this asset.

NZD vs JPY

Mixed signal.

This is NZD vs JPY weekly timeframe. Price is now at a decision point. We have about the same picture as CAD vs JPY. The support level is more obvious here though. The break below support may turn out to be a trap.

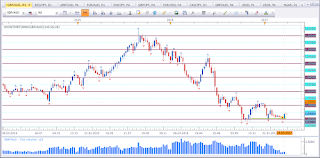

AUD vs NZD

Bearish bias for the week.

This is AUD vs NZD weekly timeframe. Price did form a Bearish Engulfing Pattern at 1,10 and below a resistance level. This puts my bias in favour of the bears. The downside of this setup is that this asset recently broke above a resistance level (marked with yellow). We may see price test this level for a bounce. Only time will tell. For now I'll look for retracements and possibly a short setup on a lower timeframe.

NZD vs CAD

Mixed signal.

This is NZD vs CAD weekly timeframe. There is not really a setup, but this asset is at an interesting level. It is worth to keep this asset on the watch list. Price did bounce off the ATH levels (the ATH zone got extended to the top of the wick) previously. Then there was a test of the red zone. Now price is below a resistance level marked in red. I am looking for this level to hold. I am not eager to trade this asset, but will monitor this with a keen eye.

GBP vs USD

Mixed signal.

This is GBP vs USD weekly timeframe. There is no setup yet. Just like mentioned in EUR vs USD this asset has a hard time moving north. The weekly close will shed more light.

A look at the USDOLLAR might shed more light into this.

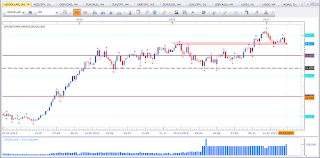

USDOLLAR

Mixed signal.

This is FXCM USDOLLAR Index weekly timeframe. Last week did close as an Indecision Candle right on top of support. The level is good, as it is a former high that got tested recently. The Indecision Candle alone is not a setup yet, but it shows that price is at a decision point. A bullish weekly close will signify Dollar strength. This would translate to EUR vs USD and GBP vs USD weakness.

DAX30 / GER30

Mixed signal.

This is DAX30 referrred to GER30 weekly timeframe. Last week close can be interpretet as bullish or bearish. Last week formed an idal looking Pinbar. The lower wick can be interpreted as a rejection of 12.000. This would be bullish. Or it can be interpreted as a Hanging Man which would be bearish. But the Hanging Man needs to get confirmed with a lower close. We may be forming a double top at ATH levels. The weekly close will tell more. I mention this asset because it is at an interesting level and very worth to keep an eye on.

EUR vs JPY

Mixed signal.

This is EUR vs JPY weekly timeframe. Price stopped right on top of 120 with a weekly Indecision Candle. This alone is not a setup, but it shows significance of the 120 level. The former Bullish Engulfing Pattern is in play and may support the prices.

USD vs JPY

Mixed signal.

This is USD vs JPY weekly timeframe. The support zone (marked with grey rectangel) is still in play. Price is having a hard time to violate the support level, which may be early signs of strength. Again, time (and price) will tell.

Nikkei225/JPN225

Mixed singal.

This is Nikkei225/JPN225 weekly timeframe. Price is in a range and the lower wick shows rejection of the range support level. I tend to take this as a bullish sign. But I do not like to trade far away from support. So I label this asset as mixed signal.

SPX500/S&P500

Bearish bias for the week ahead.

This is SPX500/S&P500 weekly timeframe. Price seems to form a top with a Bearish Engulfimg Pattern with the close breaking below the congestion zone. This puts my bias in favour of the bears. This may also be an indication for the GER30 talked about above.

GBP vs JPY

Mixed signal.

This is GBP vs JPY weekly timeframe. Price is still inside the congestion zone showing struggle to move either way. A break and close above or below the congestion zone will give a signal.

AUD vs JPY

Bearish bias for the week.

This is AUD vs JPY weekly timeframe. Price did break below with a Bearish Engulfing Pattern. this puts my bias in favour of the bears.

USD vs CHF

Mixed signal.

This is USD vs CHF weekly timeframe. Basically the close below parity would put my bias in favour of the bears. However, I am sceptical of this bearish indication. Price is in the vicinity of the support level confirmed by the previous Bullish Engulfing Pattern to the left.

AUD vs USD

Mixed signal.

This is AUD vs USD weekly timeframe. Price is at range resistance and formed an indecision candle at the yellow zone. The yellow zone did prove to be significant with all the hits to the left. The overall structure seems bullish, however as long price is below resistance, resistance comes to play. This would put my bias in favour of the bears. But currently there is not setup, hence the mixed signal.

EUR vs AUD

Mixed signal.

This is EUR vs AUD weekly timeframe. Price made a nice and strong close above 1,40. This is basically a bullish sign. However, price is at resistance. And as long resistance has not been cleared, I am not bullish. There is a good chance we see a bounce of the orange rectangle and a test of the yellow zone sometime in the future.

EUR vs GBP

Mixed signal.

This is EUR vs GBP weekly timeframe. This is an interesting asset and one of my favourites. It is difficult to gauge which one is stronger (or weaker). It seems like price wants to test the 0,90 level but is having a hard time to move. The most recent structure low is higher, so this is a bullish signal. However, price is not able to move up. We did have a Dark Cloud Cover the week before, but there was no follow through. If I needed to trade this asset, I'd look for a daily close below last bullish candle as a sing of weakness. We need patience with this asset (as with all assets, but this one requires more patience). I like to use this pair as a reference when I am trading either one currency pair, but at the moment I can't tell which one is stronger. Time (and price) will tell.

NZD vs USD

Mixed signal.

This is NZD vs USD weekly timeframe. Price is at range support, which basically is bullish. However, price seems to have a hard time to move north. If USD strength kicks in, we will see a break of the range to the downside.

GBP vs AUD

Bullish bias for the week.

This is GBP vs AUD weekly timeframe. After the Pinbar, price formed a Bullish Engulfing Pattern. This puts my bias in favour of the bulls.

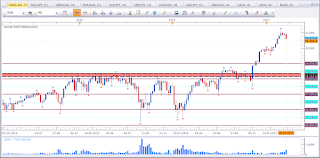

Dow Jones / US30

Bearish bias for the week.

US Oil

Mixed signal.

This is US Oil weekly timeframe. This is an asset well worth to keep on the watch list. For two weeks price has not moved much but stalled at about the same level. Sooner or later price will move one way or the other.

GBP vs NZD

Mixed signal.

This is GBP vs NZD weekly timeframe. Price is testing former ATL from the bottom. Last week formed a Doji just below resistance. This may be an early indication. We need another weekly close to estblish a bias.

There are many assets giving mixed signal. Maybe a cross currency analysis will give us a clue for the most probable path. Starting with USD we see most currencies at levels of interest. EUR vs USD and AUD vs USD are testing resistance (close to resistance) and GBP vs USD shows struggle moving north. Only NZD vs USD is sitting at support, which diminishes the outlook for a strong USD a bit. The Dollar Index sitting at support with an Indecision Candle may suggest possible Dollar strength. But we can't be sure about that until it happened. Maybe a look at the NZD pairs will show some NZD weakness, which would add odds in favour of my outlook for Dollar strength.

The cross currency analysis for NZD does not give more insight. While NZD vs JPY is sitting at support, AUD vs NZD suggests NZD strength. I like the Doji of GBP vs NZD. If this proves to be weakness, that would translate to further NZD stength. So I would be cautious trading NZD vs USD. It might prove to be healthy to wait for the weekly close.

The AUD shows two assets hinting for Aussie weakness. AUD vs NZD and AUD vs JPY have a bearish outlook. This contradicts GBP vs AUD strength.

The cross currency analysis reveals too many contradictions to give any clue for a specific pair.

Thanks for reading. If you have any questions, or would like to add something please leave them in the comments section below.

Happy trading,

TT

Keine Kommentare:

Kommentar veröffentlichen