Mixed signal.

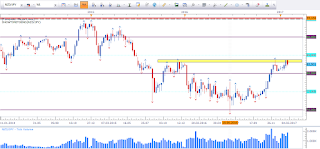

This is the weekly chart of EUR vs USD. The break below range support in December last year (talked about here and here) did prove not to be a sustained break. Price did bounce off support and is currently approaching an interesting level. This level may prove to be strong enough to reverse the up move. We need another week to define a bias. While I am bullish above range support, I am not much inclined to look for long setups next week.

EUR vs CAD

EUR vs CAD

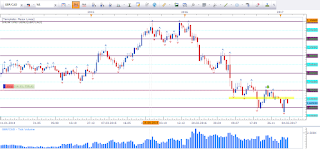

This is EUR vs CAD weekly chart. Price is sitting on top of 1,40. Basically I am bullish above 1,40. However, previous week did bounce off resistance and formed a Dark Cloud Cover, which is a bearish reversal pattern. Currently this asset is sitting between support and resitance. I could look for a long setups being so close to support. A weekly close will tell us more.

NZD vs JPY

Bearish bias for the week.

NZD vs JPY

Bearish bias for the week.

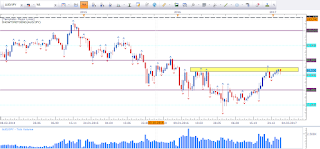

This is the weekly chart of NZD vs JPY. In my prvious report I did highlight this level and was skeptical of the move higher (here). Last week did was not able to break the level and made a bearish close without moving up. This shows me that resistance is holding and sets my bias.

GBP vs CAD

Bearish bias for the week.

GBP vs CAD

Bearish bias for the week.

This is GBP vs CAD weekly timeframe. Last week I mentioned that I doubt the sudden GBP strength (here). The close below the Doji (can be regarded as a Shooting Star also) sets my bias in favour of the bears. However, price is at a critical level and needs monitoring. Ideall I am able to add to my existing position.

This is AUD vs NZD weekly timeframe. This asset has not been easy to trade. I did only monitor AUD vs NZD as it is and stays at an interesting level. I do not really trade trendlines, but it is interesting to see how nicely this assets reacts to the trendline. Together with the level of support we have a triangle. We need a weekly close to set a bias. Basically my bias would be bullish for next week. But hitting the trendline, my bias is not bullish. I will not be looking for long setups but might get tempted to take short trades due to being so close to resistance.

EUR vs NZD

Mixed signal.

EUR vs NZD

Mixed signal.

This is EUR vs NZD weekly timeframe. Basically my bias is bearish below 1,50. However, price failed to break the support of the Bullish Engulfing Pattern which diminishes the bearishness. The weekly close might give a setup for next week. For now I see price at support. This asset may be at an early stage of another range.

GBP vs USD

Bearish bias for the week.

This is GBP vs USD weekly chart. Last week did cose with a higher wick. This is not an ideal Shooting Star. But it shows rejection of higher levels.

EUR vs JPY

Bearish bias for the week.

This is the weekly timeframe of EUR vs JPY. Price has failed to break above resistance and formed a Bearish Engulfing Pattern with last week close. This puts my bias in favour of the bears.

USD vs JPY

Bearish bias for the week.

This is USD vs JPY weekly timeframe. Price performed a strong bearish close, righ at the last week low. This sets my bias in favour of the bears. Last week I took the two rejection candles as a bullish indication and was more interested in bulls (here). However, with last week close my bias is bearish and in line with my thoughts on EUR vs JPY.

GBP vs JPY

Bearish bias for the week.

GBP vs USD

Bearish bias for the week.

This is GBP vs USD weekly chart. Last week did cose with a higher wick. This is not an ideal Shooting Star. But it shows rejection of higher levels.

EUR vs JPY

Bearish bias for the week.

This is the weekly timeframe of EUR vs JPY. Price has failed to break above resistance and formed a Bearish Engulfing Pattern with last week close. This puts my bias in favour of the bears.

USD vs JPY

Bearish bias for the week.

This is USD vs JPY weekly timeframe. Price performed a strong bearish close, righ at the last week low. This sets my bias in favour of the bears. Last week I took the two rejection candles as a bullish indication and was more interested in bulls (here). However, with last week close my bias is bearish and in line with my thoughts on EUR vs JPY.

GBP vs JPY

Bearish bias for the week.

This is GBP vs JPY weekly chart. Last week did close as a Bearish Engulfing Pattern. The two bullish candles prior to last week may have been merely a pullback. The Bearish Engulfing Pattern puts my bias in favour of the bears.

AUD vs JPY

Bearish bias for the week.

AUD vs JPY

Bearish bias for the week.

This is the weekly chart of AUD vs JPY. Even though there is no confirmed pattern, my bias is bearish for the week. Price is inside the resistance zone. As long price has not violated resistance, I treat resistance as resistance. Ideally we get a strong bearish close, which would confirm the Hanging Man.

This is USD vs CHF weekly. There is no setup as of yet. However, price is at an interesting level. Even though it appears as support got broken, it is not a strong close below support. Next candle close is going to be interesting.

This is AUD vs USD weekly timeframe. Above 0,75 I am bullish. However, price is approaching an interesting level that has proved to be resistance. Below resistance I am bearish. So I need another weekly candle to define a bias. I am very curious about how the week will close.

EUR vs AUD

Mixed signal.

This is the weekly timeframe chart of EUR vs AUD. Price is at an interesting level and very worth to keep an eye on. So far price failed to break support and is currently inside the support zone.

EUR vs GBP

Mixed signal.

EUR vs AUD

Mixed signal.

This is the weekly timeframe chart of EUR vs AUD. Price is at an interesting level and very worth to keep an eye on. So far price failed to break support and is currently inside the support zone.

EUR vs GBP

Mixed signal.

This is EUR vs GBP weekly chart. Basically last week close would set my bias as bullish. We have a Piercing Pattern at 0,85. The overall strucuture is bullish. But we have first sign of a shift in trend. with a lower high.

NZD vs USD

Mixed signal.

NZD vs USD

Mixed signal.

This is NZD vs USD weekly timeframe. There is not really a setup to define a bias off. However, price is approaching a level of resistance. I will be looking for short setups at resistance.

GBP vs AUD

Bearish bias for the week.

GBP vs AUD

Bearish bias for the week.

This is GBP vs AUD weekly timeframe. Price formed a Bearish Engulfing Pattern and closed below 1,65. This sets my bias in favour of the bears.

Happy trading,

TT

Happy trading,

TT

Thank you for sharing your knowledge. The analysis is succinct; very informative and educative.

AntwortenLöschen-Masoga

Thank you, Masoga. I appreiate your words.

AntwortenLöschen